Wise review

Using a competitive mid-market transfer rate and offering low fees (especially when compared with the banks), Wise is one to consider for your next money transfer.

Updated: 17 March 2025

Author: Kevin McHugh, Head of Publishing at Banked.

Wise uses the mid-market rate

Wise (formerly known as ‘TransferWise’) uses the mid-market rate.

What is the ‘mid-market rate’?

The mid-market rate is the middle point between the wholesale buy and sell rates for a particular currency pair (for example, New Zealand dollars and US dollars).

It’s the rate you see when you Google the exchange rate between two particular currencies and the rate banks use when trading between each other. This is why it’s also known as the interbank rate.

You may assume this is the rate you get when you make an international money transfer, but with most transfer services this isn’t the case as they add a margin on top of this mid-market rate. However, Wise does use this mid-market rate so you can have more confidence in the rate you’re getting.

Remember that, as with all international transfer services, there are fees involved.

Fees

Wise charges a transfer fee that varies with the amount you are sending and the currency you are transferring to and starts from 0.23%. The more money you send, the larger your transfer fee will be. This is a step away from the flat fee that Wise used to offer for transfers.

If you are sending money using a bank transfer, there is not additional fee. However, if you choose to a different payment method (such as credit/debit card or POLi, an additional fee will apply.

For more detail on these payment method fees, jump to the ‘Available payment methods’ section further down.

Supported currencies

With Wise you can transfer money to 80 countries in any of the following 54 currencies:

Argentine peso Australian dollar Bangladeshi taka Botswana pula British pound Bulgarian lev Canadian dollar Chilean peso Chinese yuan Costa Rican colón Croatian kuna Czech koruna Danish krone Egyptian pound Euro Georgian lari Ghanaian cedi Hong Kong dollar Hungarian forint Indian rupee | Indonesian rupiah Israeli shekel Japanese yen Kenyan shilling Malaysian ringgit Mexican peso Moroccan dirham Nepalese rupee New Zealand dollar Nigerian naira Norwegian krone Pakistani rupee Peruvian sol Philippine peso Polish złoty Romanian lei Russian ruble Singapore dollar South African rand South Korean won | Sri Lankan rupee Swedish krona Swiss franc Tanzanian shilling Thai baht Swiss franc Tanzanian shilling Thai baht Turkish lira UAE dirham Ugandan shilling Ukrainian hryvnia Uruguayan peso US dollar Vietnamese dong West African franc Zambian kwacha |

Available payment methods

With Wise you can transfer money using 4 payment methods. We give you an idea of how much you can expect to pay in fees with each method, and how long each takes to complete.

Bear in mind that the speed it takes to complete a transfer is affected by the business hours held in the country you’re transferring money. This means that choosing a payment method with a higher fee does not always mean that your money will get to your recipient faster.

Bank transfer

The bank transfer payment option is the cheapest way to send money with Wise and will be the best option for most people. However, it’s a little slower than the other options available.

A bank transfer can take between a couple of hours and the next business day for the money to reach your recipient.

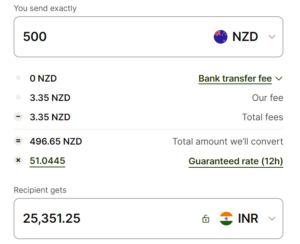

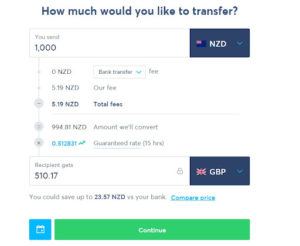

We set up transfers of $1,000 New Zealand dollars to 3 countries using bank transfer as the payment method and these are the fees we were quoted. All fees are in NZD.

| Country | Australia (AUD) | India (INR) | United Kingdom (GBP) |

|---|---|---|---|

| Total fee | $4.87 | $6:45 | $5.07 |

POLi

Transferring money using the POLi payment method will get your money where it needs to go faster, but you will pay a higher fee for the speed.

As POLi payments can potentially reach your recipient within seconds, although it may take until the next business day.

We set up transfers of $1,000 New Zealand dollars to 3 countries using POLi as the payment method and these are the fees we were quoted. All fees are in NZD.

| Country | Australia (AUD) | India (INR) | United Kingdom (GBP) |

|---|---|---|---|

| Total fee | $7.22 | $9.41 | $7.41 |

Debit and credit card payments

Both credit and debit card payments incur the same fees and transfers using this payment method take the same time to complete.

International money transfers using a debit or credit card as the payment method are significantly more expensive in terms of fees. They also take the same amount of time as a POLi payment to complete — from a matter of seconds to the next business day.

We set up transfers of $1,000 New Zealand dollars to 3 countries using either debit card or credit card as the payment method and these are the fees we were quoted. All fees are in NZD.

| Country | Australia (AUD) | India (INR) | United Kingdom (GBP) |

|---|---|---|---|

| Total fee | $19.38 | $21.50 | $19.59 |

What’s special about Wise?

Wise stands out from a lot of its competitors for a number of reasons.

Multi-currency account

Wise also offers a multi-currency that lets you store, send and receive payments in a number of different currencies.

The account includes a Wise debit card that works like your bank debit card and can be used in over 200 countries around the world. The Wise debit card includes no transaction fees for purchases made in other currencies, a feature very few other NZ credit or debit cards offer. Learn more about the multi-currency debit card on the Wise website.

Wise’s multi-currency account can be especially useful for frequent travellers, those who purchase regularly from overseas shops, and those who own and manage properties in other countries.

See how the Wise debit card compares with other options in our guide to the best travel money cards.

Transparency

Wise is one of the most transparent international money transfer services out there.

With a lot of (but not all) transfer services, you have to register with the company for a quote to find out how much a transfer will cost you. On Wise’s homepage you can find out exactly how much it will cost you to complete your transfer without having to provide any details.

Wise is also very clear about how much it charges in fees for each type of transfer so you don’t have to trawl through its website or get in contact with them to find the information you need.

Refer-a-friend

With Wise’s Invite program you can refer friends to transfer their money with Wise. If they accept the invitation, their first transfer (up to an equivalent of £500 GBP) will be fee free.

You can also benefit from a cash reward for recommending people to Wise, although exactly what this reward is for depends on which reward program Wise assigned to your account when you signed up.

If you already have a Wise account, you can find out what Wise reward program you’re a part of when you log in to your account.

Is Wise safe?

Yes, you can have confidence your money is safe with Wise. The company is regulated in countries around the world, including:

- In New Zealand, Wise operates as a foreign entity and is supervised by the Department of Internal Affairs (DIA).

- In Australia, Wise is regulated by the Australian Securities and Investments Commission (ASIC).

- In Belgium and the European Economic Area (EEA), Wise is authorised by the National Bank of Belgium.

- In the UK, Wise is authorised as an Electronic Money. Institution (EMI) by the UK Financial Conduct Authority.

- In the US, Wise is registered with the Financial Crimes Enforcement Network (FinCEN).

See the full list of locations where Wise (formerly TransferWise) is regulated and how on the Wise website.

Wise also uses 3D Secure for greater security in making online payments. Wise also uses 2-factor authentication (or what it calls a 2-step login) to improve the security of accounts.

How to transfer money with Wise

From setting up and verifying your account, to making your first international transfer, we break down all the steps to sending money with Wise.

- Get started: Visit the Wise website and select the ‘Register’.

- Enter your details: Enter your email address and select if you want a personal or a business Wise account.

- Verify your phone number: You’ll then have to enter your country of residence and your phone number. Wise still then send you a 6-digit security code which you will have to enter on the next screen.

- Verify your identity: Before you can make your transfer you’ll need to verify your ID with Wise. To verify your account you’ll need at least a photo ID and proof of address. For the photo ID a picture of your passport or driver’s licence is fine.

- Set up your transfer: You’ll first need to select how much you want to send, to which currency, and which payment you want to use. Remember, the bank transfer payment method is the cheapest option.

- Enter the recipient’s details: You’ll then need to enter the details of your recipient’s bank account. The exact details you need can vary depending on which country you’re sending money to. For the bank details you need for some of the most common transfer countries (including Australia, India and the UK), check out our guide to international money transfers.

- Complete your transfer: Next, you will have to make your payment in order to make your transfer. You will have the opportunity to review all the details of your transfer before you confirm and complete it.

- Track your transfer: You can track the progress of your transfer through your online Wise account. Wise will also email to notify you of the completion of key steps in the process, such as when Wise receives your payment and when the recipient has got the money and the transfer is complete.