PocketSmith review

The NZ-founded budgeting app has a wealth of features to make money management easier. But is it worth paying for an app to help you save money?

The breakdown

- PocketSmith lets you categorise your spending, set budgets for each category, forecast for the future, and more.

- Paid plans start from $9.99 per month (when paid annually). There is also a free plan available, although it doesn’t include the automatic bank feed feature.

- The mobile app is easy to use and offers a great way to manage your money on the go, even if it doesn’t offer the full functionality of the web app.

Author: Kevin McHugh, Head of Publishing at Banked.

Get 50% off for two months

Sign up to PocketSmith using our link below and get 50% off a monthly Foundation subscription for the first two months.

Getting started with PocketSmith

Once you’ve created a PocketSmith account, the first thing you’ll do is pull your spending transactions into the app. There are two ways to do this: set up an automatic feed from your bank, or manually the import files.

Setting up a bank feed

The easiest way to do this is to establish an automatic feed from your bank account to PocketSmith. Creating a feed will not only pull in past transactions made from your chosen account, it will also automatically bring in all transactions you make in the future. As soon as a purchase or other outgoing hits your bank, it’s available to be automatically synced with PocketSmith.

But while this feature makes things much more convenient, it is restricted to paid plans (learn more about the differences between paid and free plans further down).

To set up your bank feed, you will need to provide the details you need to sign in to your personal banking account online. To manage this step, PocketSmith uses the Akahu open finance platform, which is also used by the NZ government and several finance companies, including Simplicity and Tiger Brokers.

For most bank accounts, Akahu won’t store your login credentials. It just passes them over to your bank to verify you first. From that point, Akahu uses a token to fetch the data required on an ongoing basis.

But for some banks, this won’t be possible, and Akahu will have to store your credentials securely to maintain the feed. This can be revoked at any time. Learn more about how Akahu works with PocketSmith.

If you are concerned about providing your login credentials (or you’re on a free plan), you can choose to import your bank files manually.

Importing bank files

If you have a free account, you can still import transactions, but you will have to do it manually by exporting files from your bank in OFX, QFX, QIF or CSV format and then importing them into PocketSmith.

This process can be a bit niggly for a few reasons. For a start, choosing the best file format can be confusing and I had to go to PocketSmith’s help centre article on the topic to find out that OFX was the recommended option.

Secondly, once the file has been uploaded, the fields in the file have to be manually categorised. This is not as straightforward as it sounds as the fields in the file may not correlate directly with what you see on your bank statement.

Finally, as it’s a manual task, you have to export the file from your bank and import it into PocketSmith whenever you want to account for your latest transactions in the app.

But while it’s less convenient than simply setting up an automatic feed from your bank, the option of manually uploading transactions is still a good option for those who don’t need to monitor their spending on a daily basis.

Key features

PocketSmith has a range of features to make managing your money easier. We dive into the key ones here.

Categorisation

The categorisation of transactions is fundamental to PocketSmith’s operation. It provides the data needed to assess spending effectively, create budgets, and forecast the future.

There are a number of pre-set categories available right from the start such as ‘Groceries’, ‘Petrol’, ‘Eating out’, and so on. However, you can also create new categories that work better for you if needed.

Fortunately, you don’t have to manually categorise each transaction you make thanks to ‘category rules’. These allow you to create simple rules that allow you to automatically group both past and future transactions under a category. For example, you could create a category rule for all transactions that include the words ‘New World’ or ‘Countdown’ under the groceries category.

This means that you’ll have to spend some time categorising transitions at first but will need to do it far less often in the future.

Budgeting

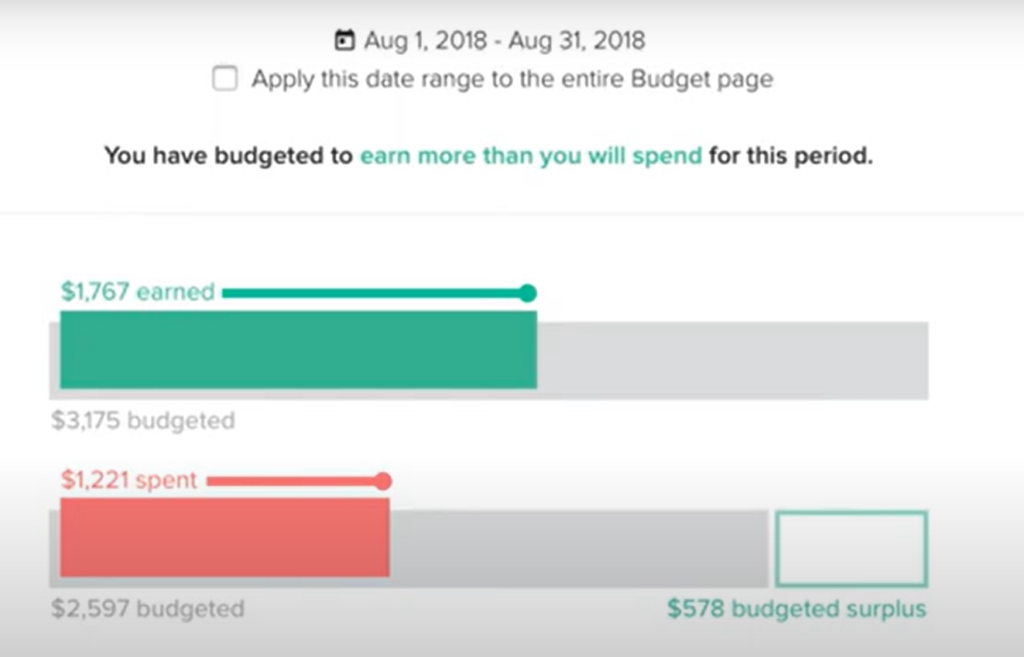

PocketSmith has a comprehensive budgeting feature that lets you create budgets for different categories of spending such as groceries, rent, utilities, and so on. The feature lets you keep a close eye on particular aspects of your spending and make sure you’re not overspending in a specific area.

When you jump into the app’s budget page, you’re presented with a budget summary that gives you an overview of your total budgeted income vs your total budgeted expenses, alongside your actual income and expenses. These bar graphs provide a helpful high-level view of your total budgets over your chosen period.

From this page, you can also manage and gain further insight into each of your budget categories. This includes setting or editing budgets (per day, week, month, and so on) and obtaining details on the transactions that fall under each budget for your set time period.

The app also has a handy auto-budget tool that automatically creates budgets for categories without budgets. However, you have to have been using Pocketsmith for a while to benefit from this feature as it needs transaction data from the past 12 months to do its job.

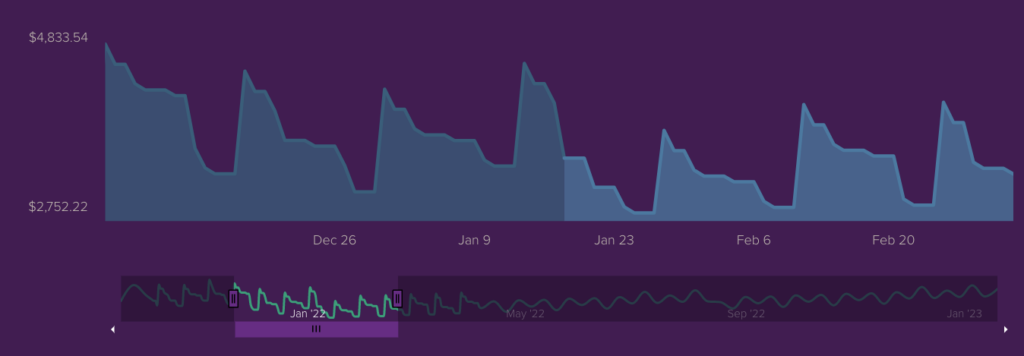

Forecasting

PocketSmtih’s calendar page shows you what transactions you have made, but it also displays your budgets for each category. This means that if you have set out your budgets for each category, you can forecast how much you can expect to spend over the next month, next year, and so on.

At the top of the calendar page you’ll see the forecasting graph. This shows your forecasted balance over the period of your choice by presenting your forecasted outgoings (based on your budgets) and your expected income (which is also set as a budget).

Below the forecasting graph is a calendar view of your spending. Past transactions are presented day-by-day under the account they came from, while dates include budget information that sets out how much you can expect to spend.

The forecasting feature of the app demonstrates the importance of setting budgets for as much as your spending as possible, whether those are weekly, monthly, or annual outgoings. The more budget information you provide, the more useful and insightful PocketSmith’s forecasting feature will be.

The PocketSmith mobile app

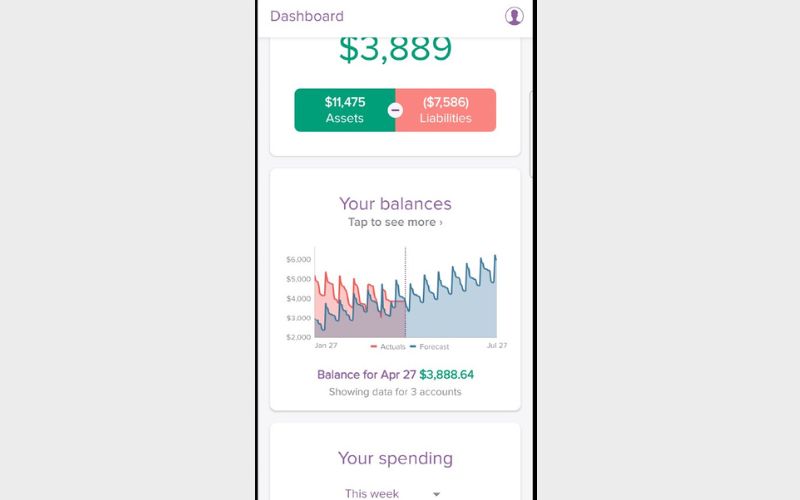

You can access PocketSmith from your phone browser, but thankfully, there is also a mobile app that makes tracking your money a little easier.

I actually found the mobile app easier and more fun to use. While the desktop experience can feel a little overwhelming with its range of tabs, widgets, and somewhat cramped information, the mobile app feels spacious and is more concerned with presenting the points you’re most likely to want when you’re out and about.

When you log in to the app you’re presented with the dashboard at the top of which is your ‘net worth’ — the total amount of money you have in your connected accounts minus any liabilities (you can add liabilities, such as outstanding loans, in the ‘Reports’ section of the app).

Scroll a little further down and you’ll find your forecast graph, a pie chart with your spending for the period of your choice, your most recent transactions, and so on. Other tabs offer a more comprehensive breakdown of your transactions, a calendar view of your spending, and a look at your budgets (and how much you have spent against each in the period you’re reviewing).

The Pocketsmith mobile app doesn’t have the broad range of data and features its desktop big brother has, but it’s all the better for it.

It’s simple to use and presents all the most important information without overloading you with information. However, it is worth noting that some reviewers on the app store would have preferred it to have as much functionality as the desktop version, so whether you will enjoy the PocketSmith comes at least partly down to preference.

The PocketSmith mobile app is available for Android and Apple devices.

Plans and pricing

PocketSmith has a range of plans to suit different needs. Many of the app’s features are available across all plans, but they are watered down for the cheaper plans. For example, on the free plan you can only forecast for up to 6 months, while the Foundation plan (the cheapest of all the paid plans) gives you projections for up to 10 years.

First up is the free plan, which actually has a pretty strong selection of features. The biggest limitation of the free plan is the lack of automatic bank feeds, which means you must manually import transactions. This does make the app significantly less convenient, but that’s to be expected in a free plan.

Other limitations of the free plan include a maximum of 12 budgets, which might sound like plenty at first, but there’s a good chance you’ll need more to account for all of your spending. With a free plan you’re also limited to just two dashboards and two accounts.

The Foundation plan includes the automatic bank feeds feature, as well as the following features:

- email support

- up to six connected banks (from one country)

- up to six dashboards

- projections for up to 10 years

- unlimited accounts and budgets.

With a price of $9.99 per month if you pay for a full year up front, and $14.95 if you pay on a rolling monthly basis, the Foundation plan will be the best option for most people who want the convenience and benefits of automatic bank feeds.

The next step up is the Flourish plan which costs $16.66 per month if billed annually or $24.95 per month if billed monthly. This plan includes everything the Foundation plan does, but it ups the number of connected banks to 18 (and for all countries), allows for 18 dashboards, and projections for 30 years.

Finally, the Fortune plan costs $26.66 per month when billed annually and $39.95 per month when billed monthly. The Fortune plan offers priority email support, as well as unlimited connected banks and dashboards, as well as projections for 60 years.

Is PocketSmith worth it?

PocketSmith is a powerful budgeting app with all the features most people will need to reach their financial goals, whether that’s saving for a major purchase or retirement, or just trying to get more visibility into their outgoings.

The app offers plenty of ways to better manage your money and plan for the future, including categorising transactions, setting up budgets, and creating personalised dashboards.

For those who want to examine their financial circumstances in detail, PocketSmith has a range of features and reporting options to suit. But it’s also accessible enough for more casual budgeters to dive in and get the higher-level information they want without having to wade through a sea of numbers. I found the mobile app in particular to be especially user friendly and a great way to monitor my money.

With that said, if you’re new to budgeting apps, getting started with PocketSmith might feel a little overwhelming at first. Setting up automatic bank feeds is simple, but if you don’t have a paid account and are importing your transactions manually, the process can be a bit niggly and it might take you a couple of attempts to get it right.

The price of a PocketSmith subscription paid will also put some people off, especially when there is a free version available — even if it doesn’t benefit from the automatic bank feeds feature.

Get 50% off for two months

Sign up to PocketSmith using our link below and get 50% off a monthly Foundation subscription for the first two months.

What others say about PocketSmith

We summarise what other reviewers had to say about PocketSmith.

“PocketSmith is fantastic for people who know their assets from their liabilities. In fact, some aspects, especially while managing bank feeds, will feel slightly familiar to users of Xero or MYOB. We’d recommend PocketSmith to young couples/families (whether homeowners or not) and anyone looking to pay off debt and start building up.”

Quashed — review from October 2023

“I think that PocketSmith appeals to a wider audience. People like me who are really interested and do try to give every dollar in my life a purpose (and I enjoy looking at rows of numbers) but also to people like Jonny who certainly do not! So, for him the graphs and pie charts instantly make sense to him at a glance and he can get the information he needs and move on.”

The Happy Saver — review from January 2019).

“PocketSmith is a 5-star product with one-star pricing. If you couldn’t get most of what Pocketsmith does for free elsewhere, it would stand out as an amazing and powerful financial tool. However, its pricing makes Pocketsmith less desirable than some competitors.

If you don’t mind the cost, PocketSmith is one of the best featured financial aggregators out there.”

Moneywise — review from January 2024

“My advice would be try it for a year. Gives you enough data to really start to understand how and when and why you spend money (& after a year you can compare like for like over a longer period and I am in to that data) I initially cringed at the fees but compared to what I’ve saved from using it is ASTOUNDING.”

Reddit user, r/PersonalFinanceNZ — posted 2020.

Frequently asked questions

Is PocketSmith free?

PocketSmith has both free and paid plans. The free plan is more limited and does not include the automatic bank feed feature, among others.

PocketSmith paid plans are more fully featured, but the free plan is still a good option for those who want to try out the app or don’t mind manually importing transactions from their bank on a regular basis.

Learn more about the differences between PocketSmith’s free and paid plans by scrolling up to the ‘Plans and pricing’ section of the review.

What alternatives are there to PocketSmith?

There are other budgeting apps out there to consider.

mybudgetpal is a free budgeting tool that can connect to your bank and help manage budgets and track your spending. It’s a more basic option when compared to PocketSmith and it doesn’t have a mobile app, but it might be of interest to more casual budgetters.

mybudgetpal is from the financial services and KiwiSaver provider Booster, but you don’t have to be a Booster customer to use the tool.

Another option is YNAB (You Need A Budget). YNAB is more comparable to PocketSmith in terms of feature set and like PocketSmith, it has a learning curve users will need to adapt to in order to get the most out of every part of the app.

YNAB is more expensive than PocketSmith, costing around $14-15 per month (the price is charged in USD so the actual price in NZD will vary with the exchange rate) for an annual plan, versus PocketSmith’s $9.99 for the same plan.

Is PocketSmith secure?

Your connection is encrypted whenever you’re connected to PocketSmith, meaning no one can intercept and access any personal or financial information. The service’s transport security (as it relates to data) was given an A+ rating by SSL Labs as of February 2024.

PocketSmith uses New Zealand-based platform Akahu to provide its automatic bank feed feature. Akahu is trusted by a number of financial services firms in New Zealand, as well as the New Zealand Government.

Where possible, Akahu doesn’t store any customer bank credentials. When it has to store those details to provide its service, those details are encrypted.

Learn more about security at PocketSmith and security at Akahu.