New Zealand’s insurance poverty premium

Do Kiwis living in poorer areas pay more for cover? We gathered hundreds of quotes to find out.

Key points

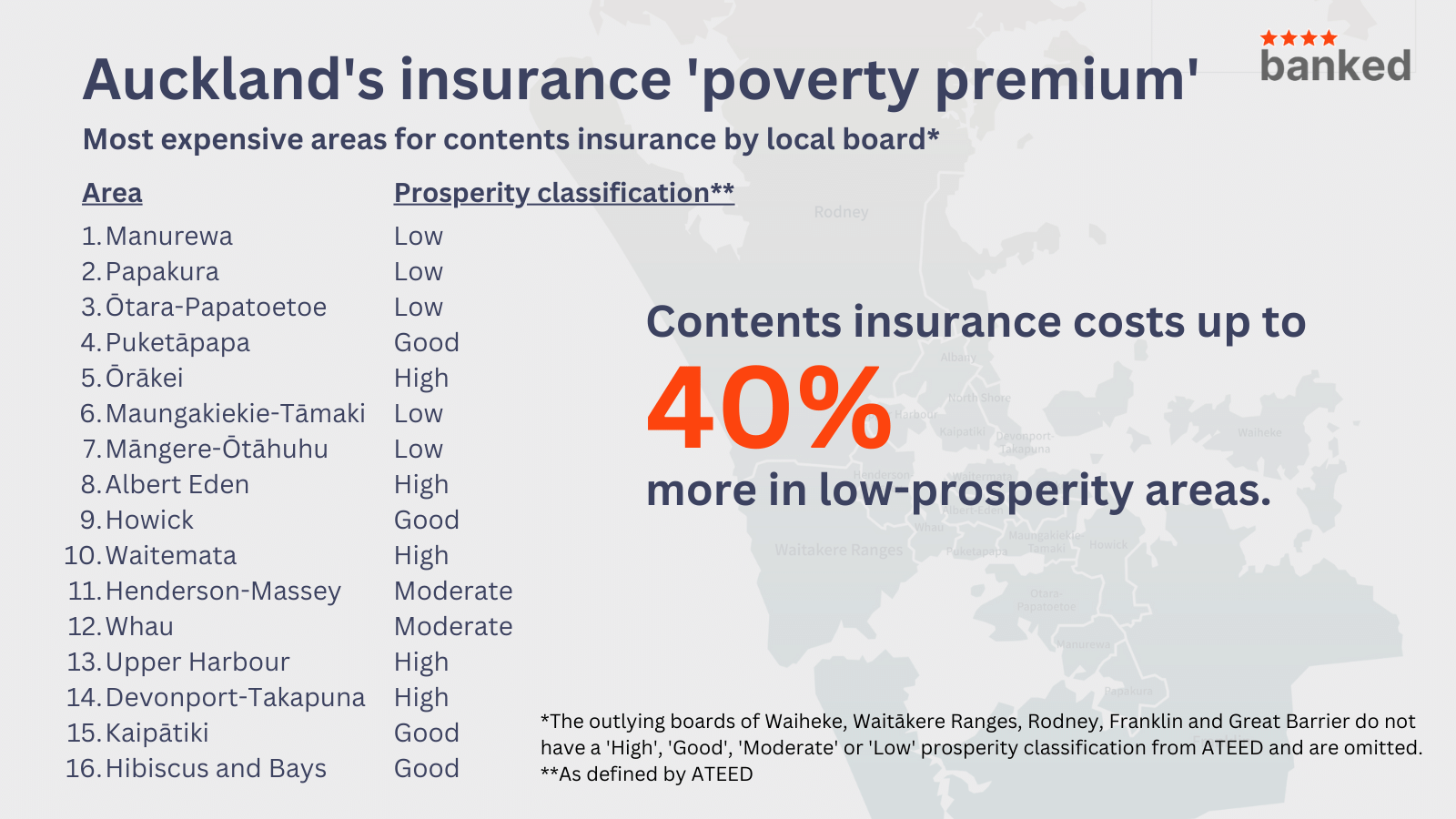

- Contents insurance costs up to 40% more for Kiwis in low-prosperity areas of Auckland.

- All Auckland local board areas classed as low prosperity are among the most expensive for contents cover.

- Poorer Kiwis less able to benefit from insurance discounts.

26 April 2023

A ‘poverty premium’ or ‘poverty penalty’ is the concept that poorer people pay more for some goods and services than people who are financially better off.

In this report, we explore how this premium impacts Kiwis in relation to insurance, with a particular focus on contents insurance.

Are Kiwis in poorer areas charged more for insurance?

Among others, one factor that insurers use to determine the cost of insurance is location.

Auckland Tourism, Events and Economic Development’s (ATEED) 2020 Auckland Prosperity Index categorises each of the city’s 21 local board areas into the five groups: ‘High’, ‘Good’, ‘Moderate’ and ‘Low’ prosperity, along with an ‘Outlying’ group.

Auckland’s local board areas fit into each of these groups as follows:

High prosperity

- Albert Eden

- Devonport-Takapuna

- Ōrākei

- Upper Harbour

- Waitemata

Good prosperity

- Hibiscus and Bays

- Howick

- Kaipātiki

- Puketāpapa

Moderate prosperity

- Henderson-Massey

- Whau

Low prosperity

- Manurewa

- Māngere-Ōtāhuhu

- Maungakiekie-Tāmaki

- Ōtara-Papatoetoe

- Papakura

Outlying boards

- Waiheke

- Waitākere Ranges

- Rodney

- Franklin

- Great Barrier

All local boards within the ‘low’ prosperity category rank well below the Auckland average for ATEED’s household prosperity index, which factors in household income and unemployment among other indicators.

Using these area classifications as a base, we gathered hundreds of quotes for contents insurance from the 16 local board areas that fall within ATEED’s ‘high’ to ‘low’ prosperity spectrum. The five outlying local board areas that do not have a prosperity classification were omitted.

Firstly, we gathered quotes from five different properties falling within each of these 16 local board areas using three different insurers (AA Insurance, AMI, and Tower Insurance), totalling 240 quotes in total. Note that all quotes were gathered between April 1–15, 2023.

Aside from the property address, the details we used to collect all quotes were exactly the same. Here are the details of our test policyholder.

- Sex: Female.

- Age: 40 years old.

- Contents value (sum insured): $20,000.

- Claims: None made in the previous five years.

- Property: A tenant in an apartment built in 1960 that is mainly made of brick veneer. No burglar alarm fitted.

Once all quotes were gathered, we calculated the mean contents insurance price for our test policyholder for each of the 16 local board areas that fall within ATEED’s ‘high’ to ‘low’ prosperity spectrum.

The results

Our research found a clear correlation between low-prosperity areas and higher average contents insurance prices.

The three highest average quoted prices all belonged to local board areas of low prosperity: Manurewa, Papakura and Ōtara-Papatoetoe. All five local board areas classed as low prosperity were in the top seven most expensive for contents cover.

We found that the average quote price in the most expensive area for contents cover (Manurewa) was 40% higher than the least expensive area (Hibiscus and Bays).

Auckland areas by average contents insurance quoted price

From most to least expensive.

| Local board area | Prosperity classification | Average quoted price |

|---|---|---|

| 1. Manurewa | Low | $550.97 |

| 2. Papakura | Low | $518.31 |

| 3. Ōtara-Papatoetoe | Low | $510.81 |

| 4. Puketāpapa | Good | $504.93 |

| 5. Ōrākei | High | $500.18 |

| 6. Maungakiekie-Tāmaki | Low | $494.14 |

| 7. Māngere-Ōtāhuhu | Low | $485.93 |

| 8. Albert Eden | High | $482.34 |

| 9. Howick | Good | $476.88 |

| 10. Waitemata | High | $464.11 |

| 11. Henderson-Massey | Moderate | $453.33 |

| 12. Whau | Moderate | $447.01 |

| 13. Upper Harbour | High | $443.17 |

| 14. Devonport-Takapuna | High | $399.69 |

| 15. Kaipātiki | Good | $395.69 |

| 16. Hibiscus and Bays | Good | $392.57 |

Download the complete set of quoted prices (xlsx).

We also conducted similar research for car insurance but found no correlation between low-prosperity areas and higher average car insurance prices.

Poorer Kiwis less able to benefit from insurance discounts

Many general insurers offer two types of discounts: an annual payment discount and a multi-policy discount.

An annual payment discount, which we found to be around 7% on average, applies when the policyholder pays for the full year’s cover upfront rather than in smaller monthly instalments.

As those with less disposable income would struggle to pay for a full year’s insurance in one go, they are less able to take advantage of an annual payment discount.

Moreover, many insurers also offer a multi-policy discount — money off for taking out more than one policy. This discount can range from around 10% for two policies to as much as 20% for three or more policies.

But those on lower incomes are less likely to have insurance and so are less able to take advantage of multi-policy discounts.

A report by the Financial Markets Authority found that people in households with an annual income of less than $100k were significantly less likely to have car, house, or contents insurance than those with a household income greater than $100k. The same report found that the cost was the greatest barrier to the uptake of insurance.

Have a question about our research?

Get in touch by emailing [email protected]